Market Review - Quarter 2, 2023

Source: FactSet

US equities rallied despite recession concerns and persistent challenges. In June, stocks entered a new bull market, up more than 20% from the October 2022 low.

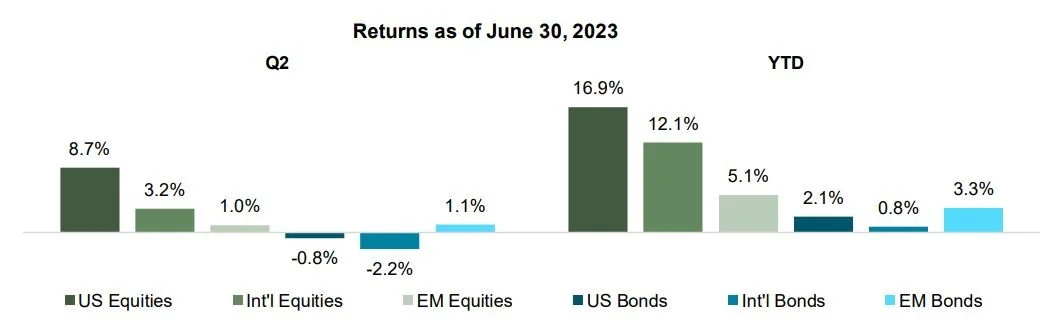

US equities were led by a handful of stocks and outperformed international equities for the quarter and year. Despite ongoing challenges, positive growth and inflation surprises helped US equities (S&P 500) gain 8.7% and 16.9% for the quarter and year, respectively. This marked the third consecutive quarter for positive returns and the best first half since 2019. However, returns have been entirely driven by the market’s largest stocks, with the top 10 companies in the S&P 500 accounting for more than 95% of the index’s year-to-date performance. In the international markets, a weaker US dollar and strong economic data generated positive returns for developed markets. Emerging markets remain the laggard, as recent economic data from China disappointed relative to expectations.

Investor enthusiasm for artificial intelligence drove stellar returns for technology and related sectors. Information technology was the best-performing sector, gaining 17% for the quarter and nearly 43% for the year. On the other hand, defensive and cyclically sensitive sectors like utilities and energy posted losses for the quarter and the year.

Across size, bigger stocks did better and, within style, technology-led growth stocks beat value-oriented dividend payers. Large caps (S&P 500) gained 8.7% and outperformed small caps (S&P 600), which only gained 3.4% for the quarter. The gap widens further, with large caps outperforming small caps by 10% for the year. Small cap index has a smaller allocation to technology which explains part of the underperformance. Finally, across style, Nasdaq, a heavy growth and technology-oriented index, gained 13.1% for the quarter and 32.3% gain for the year, while the Dow Jones 30, a value-oriented index often synonymous with dividend payers, gained nearly 4% for the quarter and is only up 4.9% for the year.

Bond returns were mixed in the second quarter. Bond yields, which move inverse to bond prices, rose as the market adjusted its expectation that the Fed would keep interest rates higher for longer. As yields went up, US fixed income lost 0.8% for the quarter but increased 1.8% for the year. Long-term bonds with greater sensitivity to interest rates were hit hardest. On the other hand, lower-quality bonds, such as high-yield bonds, made modest gains of 1.7% during the second quarter and 5.4% for the year. High-yield bonds are less sensitive to interest rates, as their performance is instead more closely tied to the stock market.

Finally, across other asset classes, commodities fell, and gold gained in the first half. Commodities, which were last year’s star performer, gave up some of those gains this year, down 2.6% for the quarter and 7.8% for the year. This means last year’s worst-performing investment, growth stocks, has been this year’s best-performing asset, and last year’s best-performing asset, commodities, has been this year’s worst-performing asset. The sharp turnaround in performance is a reminder for investors of the importance of diversification within portfolios.

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

This communication is strictly intended for individuals residing in the states of AL, AZ, CA, FL, IN, NC, OH, PA, TX, UT, WA, WV. No offers may be made or accepted from any resident outside these states due to various state regulations and registration requirements regarding investment products and services. Securities and Advisory Services Offered Through Commonwealth Financial Network (Privacy Policy), Member FINRA/SIPC and a Registered Investment Advisor, Fixed Insurance Products and Services Offered Through CES Insurance Agency.

IMPORTANT INFORMATION

This report is for informational purposes only, and is not a solicitation, and should not be considered as investment or tax advice. The information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed, and is subject to change.

Investing involves risk, including the possible loss of principal. Pas performance does not guarantee future results. Asset allocation alone cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against a loss. Actual client results will vary based on investment selection, timing, and market conditions. It is not possible to invest directly in an index.

Information presented here has been developed by an independent third party, AssetMark, Inc.

AssetMark, Inc. is an investment adviser registered with the Securities and Exchange Commission. (C)2023 AssetMark, Inc. All rights reserved.