Market Review - October 2021

Source: Zephyr Style Advisor

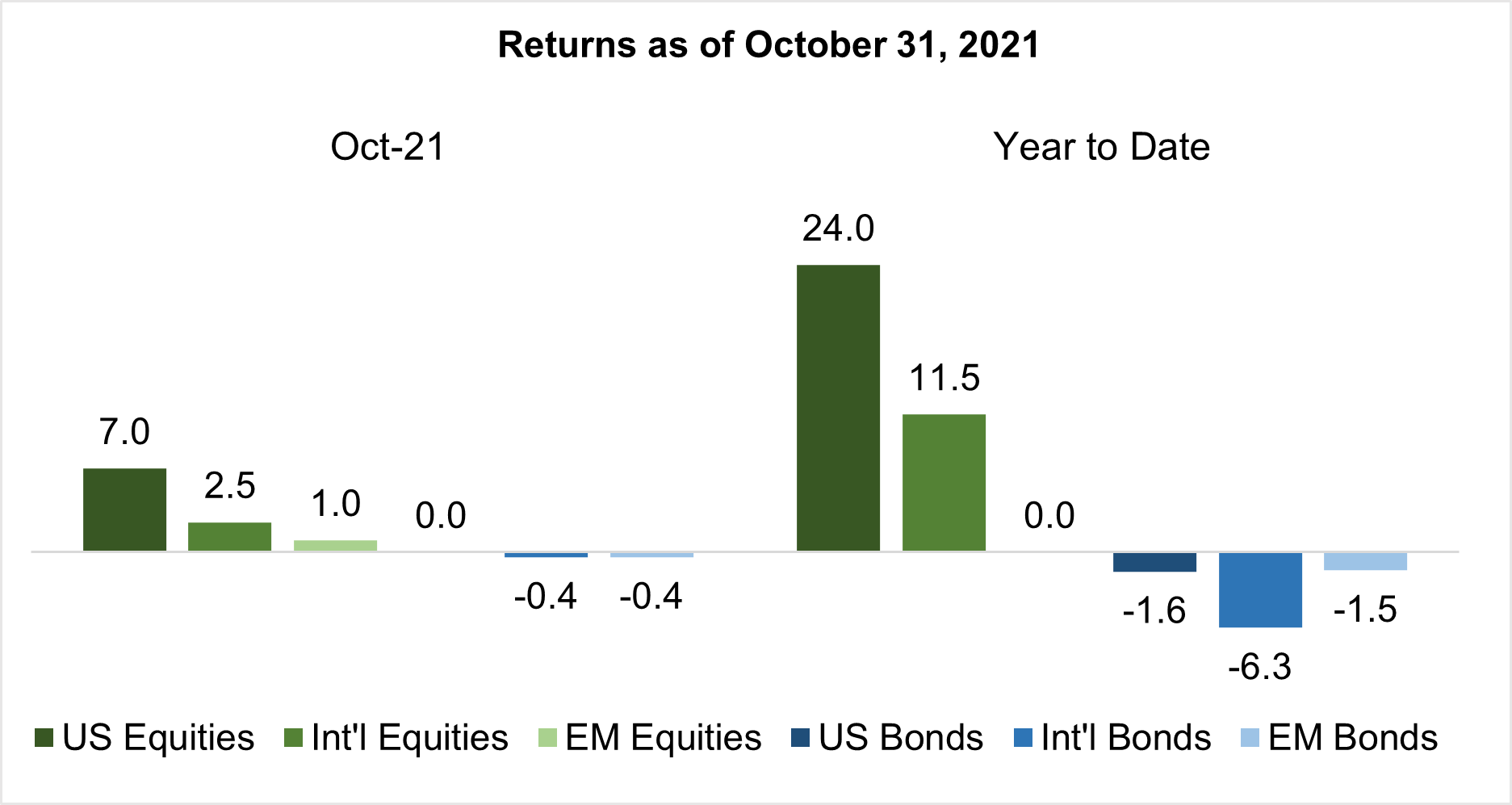

October was a strong month for equities, following a tough September. Despite ongoing concerns about supply chain disruptions and inflation, strong Q3 corporate earnings lifted the US stock market to reach new all-time highs¹. US equities led the way returning 7.0%, followed by developed international and emerging markets, returning 2.5% and 1.0% respectively. Brazil, whose central bank recently raised interest rates², continues to be a major drag in emerging markets, returning -9.4% for the month and -19.6% for the year. On the other hand, Chinese equities rebounded in October and were up 3.2% but remains negative (-14.0%) for the year. For the year, it’s notable that a strong US dollar has erased sizable gains for developed international equities which in local currency is up 17.2% year- to- date versus 11.5% in US dollars.

Looking into the US equity market, all eleven S&P 500 sectors were positive for the month. Consumer Discretionary and Energy had stellar performances returning 10.9% and 10.4% in October. Energy is now up a whopping 58.1% year to date, with financials following as the next best sector at 38.6%. Looking across size and style, large cap growth stocks outperformed small cap value stocks, a reversal from September.

Bond returns were relatively flat across the global markets. The US fixed income market returned 0.0% in October. Long Treasuries performed well, up 1.9% as the 30-year yield fell, signaling potential concerns about longer-term economic growth. Treasury Inflation Protected Securities (TIPS) also performed well, up 1.1% as inflation rose higher than expected. International and emerging market bonds were slightly down for the month, both returning -0.4%. For the year, international bonds have struggled and remains negative (-6.3%) as inflation concerns abroad have caused interest rates to rise faster than the US bond markets.

The commodity index continued to rally during October, returning 2.6% for the month and is up 32.5% for the year. Gold reversed course and rose 1.5%, as the US Dollar fell by 0.2%. US REITs returned 7.1% during the month, bouncing back from a decline in September. All major real estate sectors were positive for the month, and US REITS are now up 30.2% year to date.

Relative to a globally balanced (60/40) equity/bond index, allocations to global equites and US REITs helped while commodities, global bonds and gold hurt for the month.

Source: Zephyr Style Advisor

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

IMPORTANT INFORMATION

This report is for informational purposes only, and is not a solicitation, and should not be considered as investment or tax advice. The information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed, and is subject to change.

Investing involves risk, including the possible loss of principal. Pas performance does not guarantee future results. Asset allocation alone cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against a loss. Actual client results will vary based on investment selection, timing, and market conditions. It is not possible to invest directly in an index.

Information presented here has been developed by an independent third party, AssetMark, Inc.

AssetMark, Inc. is an investment adviser registered with the Securities and Exchange Commission. (C)2021 AssetMark, Inc. All rights reserved.