Market Review - May 2023

Source: Zephyr Style Advisor

Stocks and bonds across the globe struggled in May. US equities eked out a small gain of 0.4%, led by a handful of technology stocks. Key events during the month included a last-minute two-year debt ceiling suspension, stronger than expected US economic data, and interest rate hikes from global central banks to curb sticky inflation. Developed international equities struggled, declining -4.1% as economic conditions worsen in Europe. Emerging market equities were mixed, though declining broadly by -1.7% as Chinese equities weighed the index down with a fall of -8.4% due to slowing economic activity.

Looking across US equity sectors, market leadership has narrowed. The seven largest US technology-related stocks, which represent nearly 30% of the S&P 500 index, have accounted for all its roughly 10% year-to-date return. Digging into equity size and style, growth and large caps fared better while small and value struggled, aligning with the sector themes and the backdrop of declining inflation, improving economic growth, and investor enthusiasm for tech innovation news involving artificial intelligence.

Broad fixed-income markets were all in the negative for May. US bonds fell -1.1% as the Federal Reserve raised rates by 25bps, what many believe to be the final hike of the tightening cycle. But policymakers hinted that future hikes may still be on the table given the economy and inflation’s resiliency. International bonds fared worse, declining -2.7% as the Eurozone continued to experience sticky inflation. Short-term US treasuries offered the sole positive return of 0.3% among bond sectors.

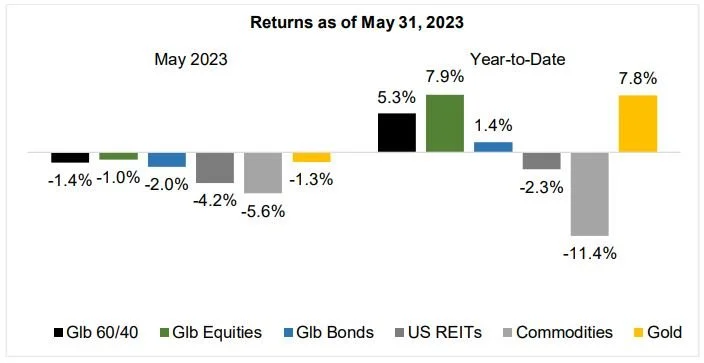

May was yet another punishing month for commodities, with the broad index falling -5.6%. Energy was the primary detractor, with precious metals in the negative as well. The US dollar strengthened in May, gaining 3.1% as inflation appears to be more of an uncertainty internationally, and investors look to the dollar as a safe haven. REITs globally retreated, with the worst declines coming from office spaces, malls, and manufactured homes.

The global 60/40 index fell -1.4% in May, with global equities outperforming global bonds. For the month, allocations to equities and gold helped relative to the global 60/40, while bonds, real estate, and commodities hurt. For the year, equities and gold continue to lead the way, while REITs and commodities remain in the negative.

Source: Zephyr Style Advisor

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

This communication is strictly intended for individuals residing in the states of AL, AZ, CA, FL, IN, NC, OH, PA, TX, UT, WA, WV. No offers may be made or accepted from any resident outside these states due to various state regulations and registration requirements regarding investment products and services. Securities and Advisory Services Offered Through Commonwealth Financial Network (Privacy Policy), Member FINRA/SIPC and a Registered Investment Advisor, Fixed Insurance Products and Services Offered Through CES Insurance Agency.

IMPORTANT INFORMATION

This report is for informational purposes only, and is not a solicitation, and should not be considered as investment or tax advice. The information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed, and is subject to change.

Investing involves risk, including the possible loss of principal. Pas performance does not guarantee future results. Asset allocation alone cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against a loss. Actual client results will vary based on investment selection, timing, and market conditions. It is not possible to invest directly in an index.

Information presented here has been developed by an independent third party, AssetMark, Inc.

AssetMark, Inc. is an investment adviser registered with the Securities and Exchange Commission. (C)2023 AssetMark, Inc. All rights reserved.