Is this a 24-karat year?

Key Takeaways

Gold prices reached a new record high in 2024 driven by demand from global central banks.

Gold is not a panacea. The shiny metal has not performed as well as stocks or bonds in the last 33 years but does act as a diversifier in portfolios.

Before rushing to buy gold, investors should ensure the reason for owning gold is well understood.

Gold has risen to new records in 2024. Headlines that Costco has started selling gold bars and, in fact, selling out have gone viral. For Bruno Mars fans, there appears to be twenty-four-karat magic in the air. The recent rise in gold is not new, as gold has captivated humanity for centuries. Apart from its shine, is gold a good investment? In this issue, we explore a brief history, some of the drivers of the recent rise in gold prices, and considerations for adding gold to the portfolio.

A brief history of gold

Gold has been used as a currency since ancient times. In modern times many countries fixed the value of their currencies to gold, and this became known as the Gold Standard. Eventually, governments needed flexibility to expand monetary supply beyond the gold standard, so they introduced the Bretton Woods System. This system fixed the dollar to gold at a set price of $35 per ounce and fixed international currencies to the dollar.

Starting in the 1960s, as the United States began to run large deficits, strains began to emerge, and eventually, the U.S. fully abandoned the link to gold in 1971, leading to the collapse of Bretton Woods. This allowed the price of gold to float freely. Following this, gold prices surged during the hyperinflationary period in 1970. Then came the 80s and 90s when gold prices stagnated. Trends, however, started to change with the new millennium. Gold started 2000’s at about $300. It then increased exponentially to recent records at $2400.

Gold Prices - Last 100 Years

Source: MacroTrends

What’s driving gold higher?

The price of gold is driven by a combination of different factors rather than a single cause. These factors include supply and demand, real interest rates (adjusting for inflation), and the level of the U.S. dollar. Gold has an inverse relationship with the U.S. dollar and real interest rates. When the dollar or real interest rate rise, gold prices tend to fall. The fall in interest rates explains a large part of the price increase in gold from 2000 to 2021 when interest rates steadily progressed lower and were amplified by zero interest rate policies started during the Great Recession, which sent real interest rates into negative territory.

However, gold prices have recently been rising in tandem with the U.S. dollar and real interest rates. Increased demand from central banks has been a key driver for rising gold prices, despite the recent rise in interest rates as well as the strength of the U.S. dollar. The increased demand is likely being driven by rising global debt levels and increased demand from countries like China looking to shift reserves away from U.S. dollars, while other central banks look to gold as a hedge against inflation and source of stability, given increased geopolitical concerns.

Should investors buy gold?

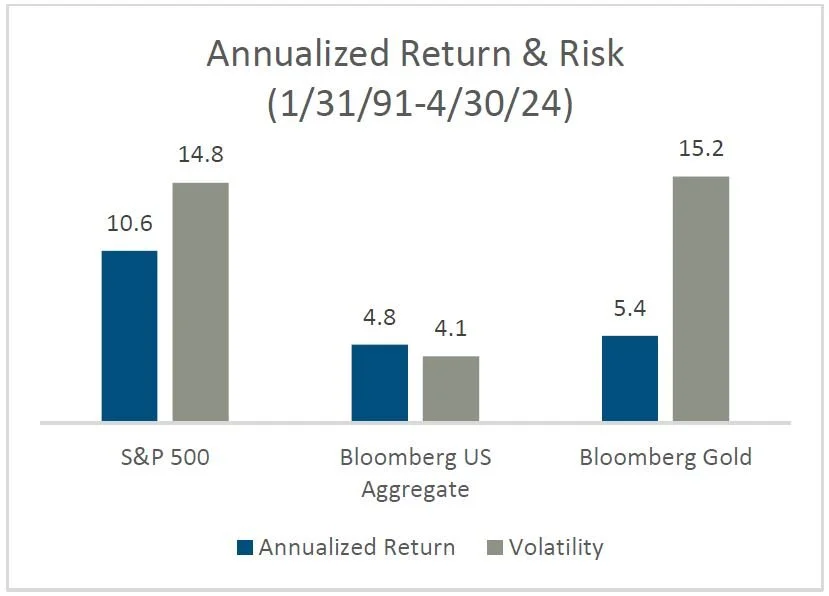

While gold has seen a strong rise in prices recently, it is not a panacea. Over the last 33 years, it has underperformed U.S. stocks (S&P 500) with higher risk. In comparison to U.S. bonds (Bloomberg US Aggregate), gold is roughly 3.7x as volatile with similar returns. Gold also does not pay a dividend or coupon like stocks or bonds.

However, gold can be a diversifier in a portfolio. This was perfectly illustrated during periods like the Great Financial Crisis, the COVID crash when stocks fell greater than 15%, as well as 2022 when global stocks lost -20%, global bonds lost -16%, and gold rose 3%.

Source: FactSet

For investors, there are several ways to add gold to portfolios beyond owning the physical asset through gold coins and bars such as gold mining stocks or exchange-traded funds. As always, before venturing down one of the many gold investing avenues, investors should assess their personal risk-reward and ensure the reason for owning gold is well understood by partnering with their trusted financial advisor.

IMPORTANT INFORMATION

This report is for informational purposes only, and is not a solicitation, and should not be considered as investment or tax advice. The information has been drawn from sources believed to be reliable, but its accuracy is not guaranteed, and is subject to change.

Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results. Asset allocation alone cannot eliminate the risk of fluctuating prices and uncertain returns. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy, such as asset allocation, can guarantee a profit or protect against a loss. Actual client results will vary based on investment selection, timing, and market conditions. It is not possible to invest directly in an index.

Information presented here has been developed by an independent third party, AssetMark, Inc.

AssetMark, Inc. is an investment adviser registered with the Securities and Exchange Commission. (C)2024 AssetMark, Inc. All rights reserved.